Forex Market Clock For Mac

Forex Market Hours Clock-Live: This is the live Forex market hours clock. Text editor for mac show line endings. Set your current time zone and the clock will show you which market is currently open. I have used quite a few of these clocks and I like the Oanda market hours indicator best. This graphical representation is the easiest one for me to use and I hope you like it too.

- Forex Market Clock Desktop

- Forex Market Clock For Mac Os

- Forex Market Clock

- Forex Market Clock For Mac Desktop

- Welcome to my Forex clock. This Forex clock was specially designed to help traders keep track of the different Forex trading sessions. The clock is great for keeping track of how many hours until a specific trading session opens or closes. It will automatically adjust to your computers times.

- Any advantage you can get in Forex trading counts so we’ve looked at the best forex trading platforms for Mac and Windows in 2020. While Windows users can use just about any forex platform, forex trading on a Mac is a little more complicated due to the lack of platforms and software that support macOS but we’ve reviewed the best trading platforms for Mac in 2020.

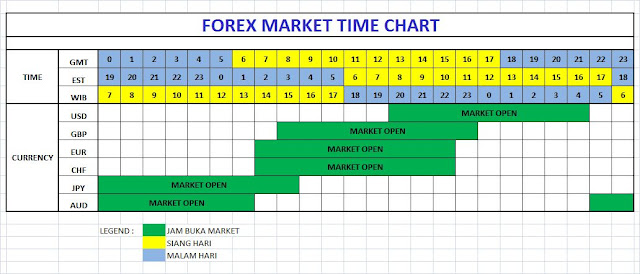

The forex market is arguably the most liquid market in the world. Its open 24 hours a day, 5 days a week. Time is one of the key components of becoming a profitable trader. But before you execute a position, it’s important that you understand the flow of the market. Generally speaking, the market is broken down into three main sessions: Asian, London, and New York session.

When more than one session is open, there is high volatility. This translates to greater trading opportunities. Not to mention, the number of traders buying or selling a particular currency pair increases. The best way to keep track of your trades is to use a forex market hour clock – it automatically adjusts to your computer time. Read on and learn more.

How the clock can help in each trading session

Asian trading session

It starts at 6.00 pm Eastern standard time and ends at 4.00 am EST. During this time the liquidity appears to be thin, but you can still get the best trading opportunities. Additionally, the economic calendar has high-impact news for Japan, New Zealand, China, and Australia. This means you have the perfect opportunity of trading JPY, NZD, and AUD currency pairs. It’s worth mentioning that currencies consolidate during the Asian session if London and New York session have big moves. Keep in mind that more than 21% of currency transactions take place during this period.

London session

The session starts at 3.00 am Eastern Standard Time and ends at 12.00 pm EST. This is usually one hour before the Asian session closes. Over the years, London has been the major session for trading. When the two sessions overlap, there is high liquidity and lower pip spreads. Volatility is ideal for day traders who use price action strategy when executing their trades. Godmode for mac sierra 10.13. The major news releases in this session affect GBP, CHF, and EUR currency pairs. It’s estimated that about 30% of trading take place during this period.

NY trading session

This session opens at 8.00 am Eastern standard time and runs until 5.00 pm EST. This session is considered the most active time for trading- for good reasons. Majority of the economic reports are released. You’ll find all the news that affect CAD and USD. Therefore, any pair that has the Canadian dollar or the U.S dollar as the base currency tends to move a lot. But when the market closes, the volatility goes down. It’s estimated that 80% of forex transactions are handled during this period.

What do market hours mean for traders?

No matter where you are, you can execute trades in any of the above sessions. However, this does not mean that you get glued on your computer the whole day. You only need to check the market once or twice a day. This works well if you’re trading after the normal working hours. Another point to note is that the market closes on Friday and opens on Sundays. If you want to be a consistently profitable trader, you should avoid trading on Sundays due to low volatility. Also, there is always a mixed sentiment in the market.

The best days to trade is on Tuesday, Wednesday, Thursday, and Friday until 12 pm EST (when London closes). This does not mean you can’t trade on Mondays- it’s only that there are more price movements than the rest of the days. The trading setups and time goes hand-in-hand. You should read the fundamentals (news) and the technical (forex charts) before trading.

The best hours to trade the forex market

Although the market is open throughout the day, you should not trade every hour. A golden rule of thumb is to trade during high levels of activity in the market. Other than that, you should ensure the spreads (the difference between the bid and ask price) are low. When one session overlaps the other, the volatility goes high and the market presents the best trading opportunities.

If you’re a day trader, the London session is the best for you. And if you’re looking for a stress-free trade, you may want to look at the forex charts at 5 pm EST. Remember, you can still trade breakouts during the Asian session.

Whether you’re a swing or a position trader, time matters a lot. For instance, EUR/USD moves during certain market hours. Why not take advantage and trade when the volatility is low? If you stick to specific hours of the day like 2 pm to 6 am EST, you can be successful in the long-run. Of course, this applies to other currency pairs (especially the majors). If you’re a beginner, you need to develop a trading strategy that gives the best hours for trading.

Setting a trading schedule

If you want to be a consistently profitable trader, you have to set a trading schedule. This will increase your odds of success. You can time your trades before the overlap occurs or immediately after major news releases. Start by understanding why London and New York sessions are the best to trade. Note: some sessions offer transitional liquidity for major currencies while others provide additional liquidity for cross currencies.

Riskier forex trading hours

Every experienced trader knows there are times when the forex market tends to be riskier. This can put your trading account at risk if you have poor money management. The trading sessions typically deteriorate and may be characterized by things such as greater slippage on orders, reduced liquidity, and wider dealing spreads. However, you can still trade during such market hours. Just make use of the technical data because it often discounts all other available data. Let’s look at trading hours when the forex market tends to be riskier.

- Sunday and Friday afternoon

Although the currency market is open during such times, the dealing spreads are wider not to mention liquidity is often thin. Keep in mind there are fewer market participants during these hours.

Forex Market Clock Desktop

- Major news releases

You can easily burn your hard-earned money if you enter trades during the major news releases. Examples of high-impact news include ECB, Non-farm payrolls (normally released the first Friday of the month at 8.30 AM EST), FOMC, and more. The market also moves a lot during disasters, elections, or when announcements are made influential central banks.

- Bank holidays

Trading during bank holidays can be problematic in one or more major trading centers. However, you can still take advantage of the major price movements.

Final thoughts

Forex Market Clock For Mac Os

Forex Market Clock

There are no specific hours when you should trade in the forex market. However, the best opportunities present themselves when two

Forex Market Clock For Mac Desktop

sessions overlap. No matter the currency you wish to trade, stick to specific times and follow your strategy to the latter. And before you make your investment decision, make sure you analyze the volatility profile of each currency pair.